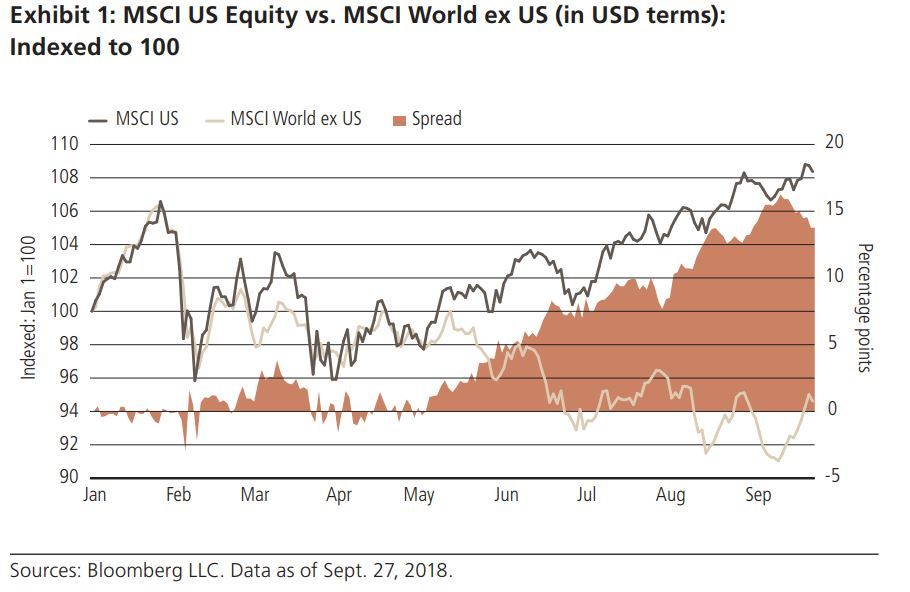

2018 has been a year of stark divergence in asset performance for the US versus the rest of the world (RoW). Year to date, the MSCI US equity index has outperformed the MSCI ex US by 13% in dollar terms (exhibit 1). The spread between 10-year nominal Treasury and bund yields has widened by 60 bps and now hovers near 30-year highs. And the dollar staged a powerful counter-trend rally, contributing to widespread weakness across emerging markets asset classes. In this Macro Monthly, we examine what is behind this widening asset divergence, what history tells us about these kinds of divergences, and what we believe will be the likely drivers of relative performance over coming quarters.

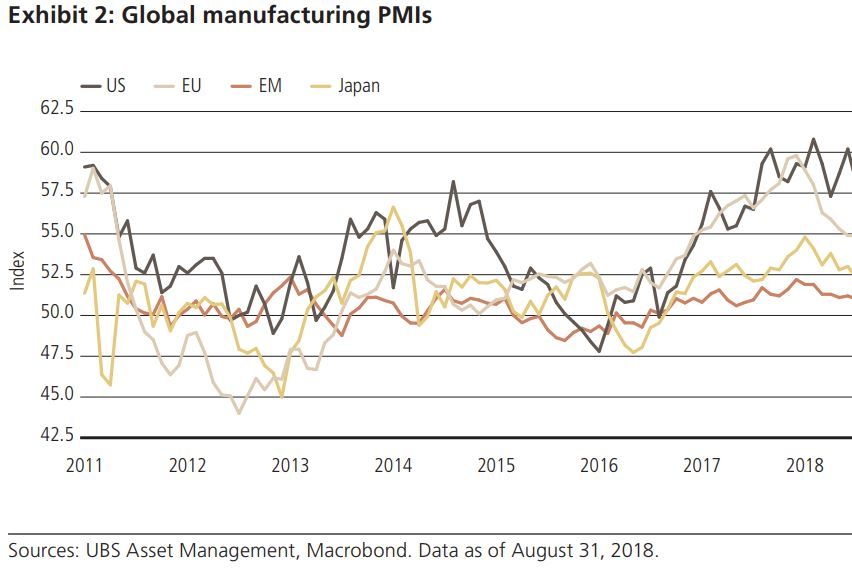

The simplest explanation for US equity outperformance this year is economic divergence that has translated into equally divergent corporate earnings profiles. The synchronized global growth of 2017 ended abruptly earlier this year, with economic data disappointing in much of the rest of the world, in part driven by the lagged effects of Chinese deleveraging. Meanwhile, US economic growth accelerated on late-cycle fiscal stimulus (Exhibit 2). Against this backdrop US company profits have grown strongly – beating even upbeat expectations over the past few quarters – while corporate earnings outside of the US have stuttered and in the case of Europe, disappointed.

Increased trade tensions have also played a role, with the market judging that tit-for-tat escalation of tariffs will disproportionately affect more trade-dependent nations than the US. China is now engaging in monetary and fiscal stimulus to cushion its economy against the effects of prior de-leveraging and trade tensions, which could help offset some of the recent US-RoW growth imbalance.

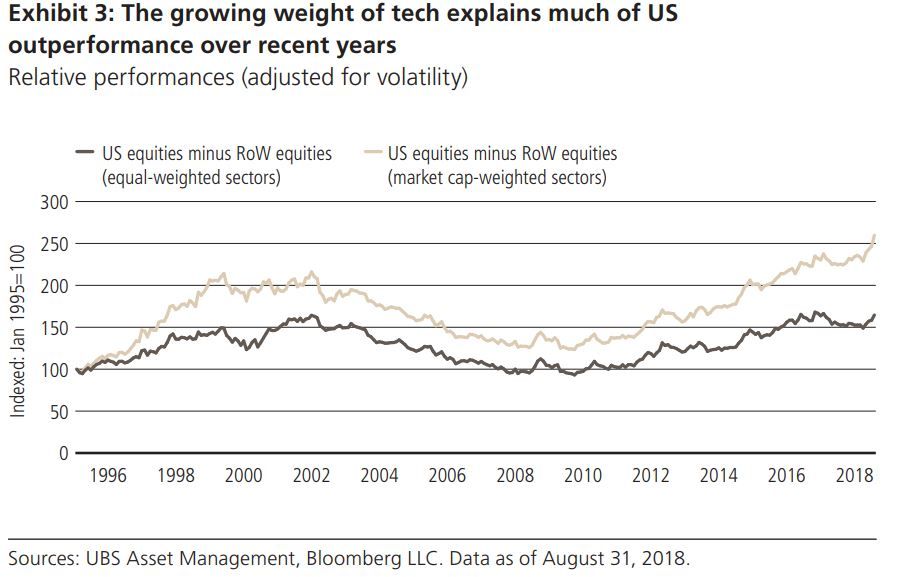

Specifically within equities, the persistent outperformance of growth versus value is naturally beneficial to the US, where a higher percentage weight in fast-growing Information Technology companies relative to more value-heavy indexes like Europe and Japan will naturally favor US outperformance. Indeed, using an equal-sector weighted rather than market-capitalization weighted index comparison between the US and the RoW, one can see that much of the outperformance from the US over the last couple of decades can be attributed to the growing index weight of tech, which typically trades at a higher price-to-earnings multiple relative to other sectors (Exhibit 3).

What does history tell us?

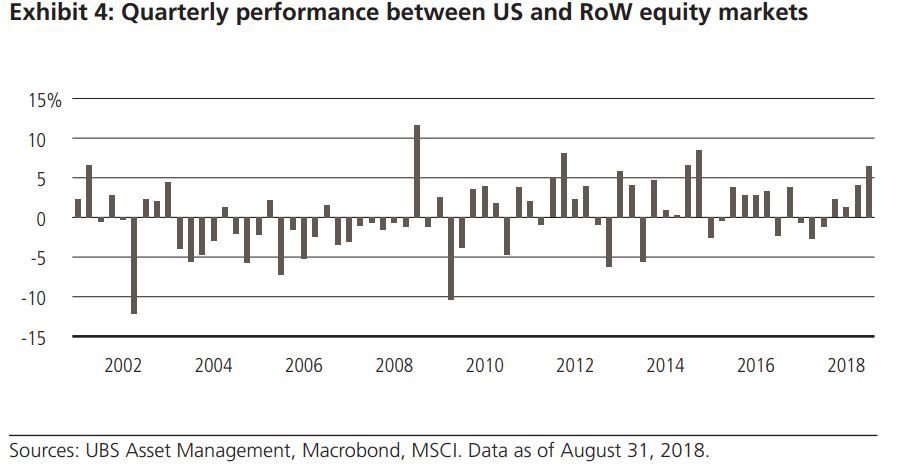

We examined periods of US equity outperformance versus the RoW (Exhibit 4) and make a few observations. First, multi-quarter periods of US-RoW outperformance are not uncommon (nor are periods of RoW-US outperformance). That said, the magnitude of recent divergence (double-digit % outperformance) over two quarters, is fairly large relative to history. Since late 1990s, we have only seen two instances in which a separate six-month period had a divergence of greater than 10% (in earlier decades, such outperformance was more common). In both cases, we did not observe strong mean reversion in the following quarters; in fact, momentum can continue for some time, and since the post 2007-08 financial crisis period in particular, there were more periods of US outperformance than otherwise. In any case, simply looking at historical data can tell us how unusual certain behavior is relative to history, but it may not always be a great indication of the future. This is especially true if the underlying drivers of such behaviors change over time. As usual, our view on whether US outperformance is likely to continue will come down to our assessment of how we expect macro and financial themes to develop across regions versus what is currently priced in.

The outlook from here

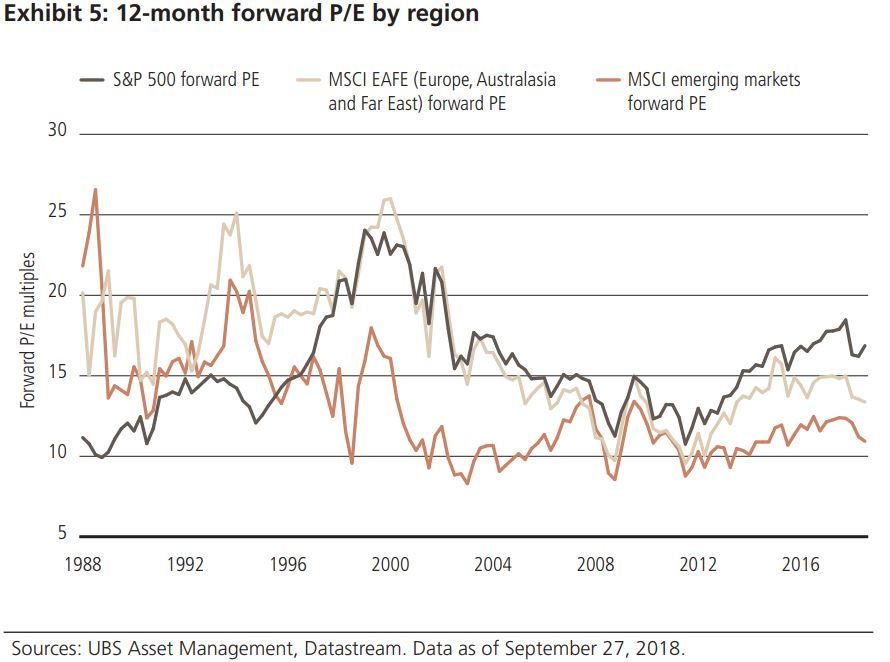

At the moment we think the US is in the midst of a positive feedback loop between a robust economy and still accommodative financial conditions. Strong economic performance has boosted confidence to borrow and invest while broad financial conditions remain easy even amid Fed hikes. While we recognize that plenty of good news is in the price, and the economy is later cycle, we do not want to stand in the way of this ‘positive reflexivity’ until we see clear signs of a breakdown in leading indicators including business and consumer confidence. Perhaps this will be the case if the US business community more fully takes into account the impact of recent trade escalation and slows investment and employment plans, evidence of which we have yet to see. And while we recognize relative valuations between value and growth are extreme, we are not confident there is a powerful enough catalyst (such as materially higher rates or a spike in tech regulation) to reverse these trends in the near term. Note as well that despite another strong year of outperformance, US equities are now more attractive than they were after profits have grown faster than share prices have risen (as measured by the twelve month forward P/E ratio). This suggests that US equities can continue to perform, even if recent momentum moderates somewhat.

When looking at the rest of the world, we acknowledge that a lot of bad news is in the price, and that valuations have adjusted. And our thesis remains that overall global growth, including outside the US, will remain above trend as still easy monetary conditions in developed markets and China’s monetary, fiscal and regulatory stimulus cushion growth against prior deleveraging and escalating trade tensions. Based on this outlook and more attractive valuations, we are constructive on Japan, emerging markets and Europe over our 12-month tactical horizon. But in order to move materially overweight these regions relative to the US, we want to see more evidence of growth stabilization, which has been tentative so far. Over the coming quarter, we are keeping a close eye on China’s credit data, raw industrial commodity prices, and ex-US developed market consumer and business confidence as key indicators of growth stabilization. And of course, geopolitical risks such as potential further trade escalation and an exacerbation of tensions between Italy and European authorities bear close monitoring.

On a global basis, we remain constructive on equities given above-trend global growth, still easy financial conditions, and limited recession risks over the next year. But despite strong US outperformance year to date and less attractive valuations compared to other regions, we are not looking to be actively underweight the US versus Europe, EM or Japan at the moment. Our focus remains on economic data: If we see genuine signs of stabilization in China and ex-US developed markets, or perhaps a greater appreciation of tariff risks in the US economy, we would be more inclined to shift relative preferences. Likewise, a durable pickup in inflation in Europe and Japan would give us more conviction in entering bond convergence trades, to take advantage of historically wide spreads. Ultimately we expect the time for convergence to come, but we are not convinced it has arrived just yet.