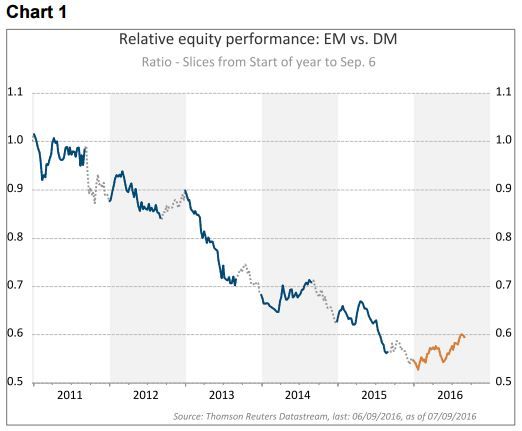

So with the thought “Once bitten, twice shy!” in mind, investors are increasingly asking themselves whether the current EM outperformance will prove – as it has so often in the past – to be a brief, spirited but short-lived, sprint or turn out to be a marathon run that can last.

Here, we briefly provide our views, taking into account our previous ideas. Indeed, this April, we strongly endorsed overweighting EM over DM, not just tactically, but over a longer time horizon (cf.: Will the monkey smile on emerging markets? - April 2016). We confirmed this position in July (Brexit doesn’t mean an EM exit! - July 2016), taking into account the decision of the UK to leave the EU. We still hold this view, while acknowledging that a more uncertain US interest-rate outlook since the lateAugust annual gathering of central bankers at Jackson Hole might trigger profit-taking on this so far profitable trade.

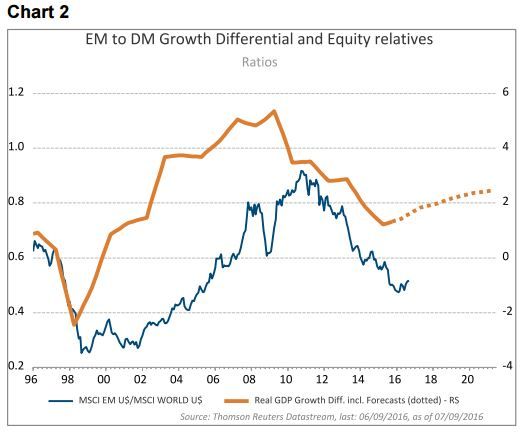

Firstly, this ’strategically’ constructive view is based on the fact that growth in emerging economies, in both real and nominal terms, has once again started outpacing that of developed countries after lagging it for about five years until Q3 2015. Economists and public institutions are forecasting that emerging economies’ GDP will expand more rapidly than the output of developed markets both this year and next. Interestingly, the consensus sees the growth gap widening both because GDP growth in DMs is slowing and – more importantly – because it is accelerating in EMs.

Furthermore, it is domestic rather than external drivers that are judged to be contributing the most to the expansion of EM economic activity, in the form of increased public investment, stronger consumption and a developing services sector. Admittedly, it is Brazil and Russia, which seem set to move out of deep recessions in 2017, that are likely to be the main contributors to EM’s growth acceleration. Indeed, barring China, which admittedly is a heavyweight in its own right, most other emerging economies are forecast to expand faster as we move into next year. If history is a good guide, the relative performance of emerging equity markets versus developed ones should be well supported by a sustained widening of the growth differential (chart 2), all the more so as EM equities are still trading at big discounts to their DM peers in price and valuation terms.

The contraction of the growth differential between EMs and DMs in recent years was a greater headwind to EM equities as it coincided with a slide in commodity prices. However, the recent news is more positive on this front, too. In fact, most experts appear to agree that the drop in commodity prices, notably those of crude oil, is behind us. Given the still large supply overhangs in various commodities, the consensus sees prices remaining volatile and moving up only gradually, while supply and demand slowly rebalance. Crude oil prices, for instance, which dropped to a low of around USD 22 per barrel at the end of this January and have moved back to around USD 48/bbl at the time of writing, are expected to grind slightly higher to around USD 52/bbl by the middle of 2017.

In our view, less (although not zero) macroeconomic risk in emerging markets, the rise in global liquidity and the perception that global central banks would not tolerate even a minor deflection from their targeted path to reflation are together strongly contributing to the current outperformance of risk assets, including EM bonds and equities. In fact, in such a ‘risk-on’ (low volatility) environment and against the backdrop of zero, or close to zero, global core bond yields, the idea that additional central bank liquidity would benefit risk assets can be seen as simply rational, although a major part of such investment would be occurring more by necessity than by choice.

So we think one of the most important questions to ask here is what would happen if investors started to anticipate a structural shift in major central banks’ monetary policies towards tightening, with a gradual retrenchment in global liquidity as a consequence. In our view, the outcome would depend on how the transition from an ’exceptional’ monetary policy regime towards policy ’normalisation’ is conducted. No doubt, this potential scenario lies essentially with the US Federal Reserve (Fed) as the ECB can be expected to be adding rather than reducing monetary stimulus, Japan is likely planning greater monetary and possibly fiscal support and the Bank of England joined the quantitative easing party after the Brexit referendum.

Looking ahead, we see three options for Fed policy, of which we think only one is likely to hamper EM equities’ outperformance. First, the Fed remains on the side-lines, merely keeping policy rates at their current level for the foreseeable future. Second, the Fed increases rates, but markets consider this a mistake. Third, the Fed gradually tightens/normalises monetary policy against the backdrop of solid fundamentals.

Case two is the only one which would be likely to derail our scenario of a more durable EM (bond and equity) outperformance. Yet the consensus view, and our own, is that it is also the least probable. In fact, the overcautiousness of a highly data-dependent Fed shows that this option is precisely what it wants to avoid. We believe monetary policy normalisation will only resume once the Fed believes the US economy is on a sustainable growth path and risks to global growth or financial markets are small and manageable. That is scenario three.

In this case, the risk-rally would likely be interrupted only temporarily and not definitively halted; we think more durable growth would largely compensate for a little less policy accommodation. In shape, not in amplitude, the unfolding of this option would most likely resemble the patterns that markets followed during the rate hike cycle that started in mid-2004. As was the case then, global economic growth is positively sloped, commodities are slowly rising again and EM equities and bonds currently look cheap relative to their DM peers. Incidentally, last time around, EM currencies appreciated rather than depreciated against the US dollar, although global GDP growth was much faster than is currently the case.

This option appears now somewhat more likely than option one, judging by the more confident, although still measured tone from the Fed at the Jackson Hole conference. Meanwhile, market participants are currently putting a roughly 24% probability on a Fed hike in September, rising to 52% for a move in December.

Should the Fed decide to sit back and do nothing for the foreseeable future – as per option one – the hunt for yield and growth, and thus the support for EM assets, would continue, unless a recession in the US creates the reason to retain or even soften the current monetary policy stance. Should the latter occur, EM assets – in common with most other risk assets – would suffer a substantial blow, all the more so as the US dollar would at least initially likely strengthen given its safe-haven status, while already oversupplied commodities would likely tank.

In conclusion, we believe that the odds on EM equities continuing to outperform remain good, all the more as the asset class is still not overweight in global portfolios. Also, further underpinning this view are the increasingly strident calls for budgetary support as a complement to ease monetary policy, as heard at the current discussions at the G20 meeting in China. Incidentally, both contenders in the US presidential election plan to increase public investment if elected. Adding fiscal support to a less efficient monetary policy should be greeted by risky assets. Meanwhile, there are numerous risks, the most prominent, as highlighted above, being a Fed ‘faux-pas’. And the risk of profit-taking on stellar EM performers also looks likely before year-end, in our view, again given the rising uncertainty over the next moves by the Fed."

Patrick Mange

Head of APAC & EM Strategy

BNP Paribas Investment Partners