Investment background

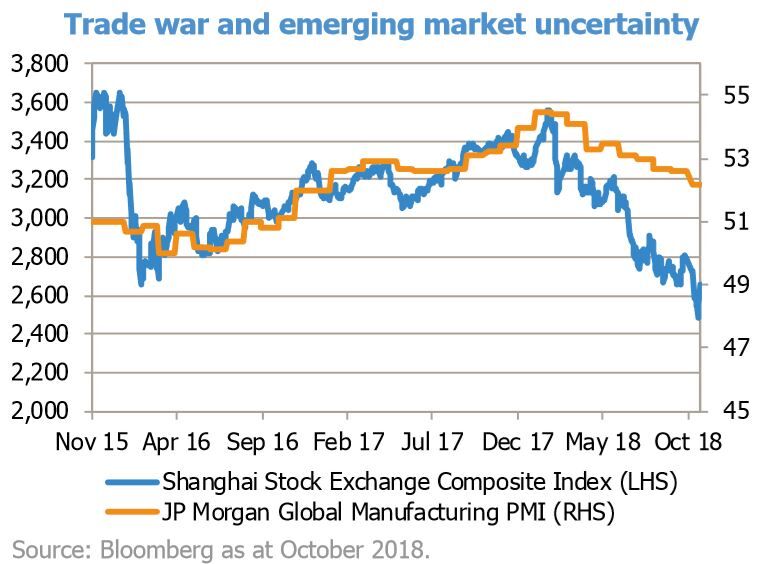

Not for the first time, it was a tough October for equities globally. A number of uncertainties came together to cause a rapid decline in confidence and stock market levels. We have covered some of the burgeoning issues over recent months: for the UK, the ongoing EU withdrawal negotiations, for the eurozone, the escalating political and fiscal uncertainty in Italy (joined now by political uncertainty in Germany after Angela Merkel’s recent announcement to stand down as leader of her party); and, on a global level, the deepening trade tensions between the US and China. Add to this backdrop the ongoing interest rate rises in the US in the face of continued economic strength, the public denouncements by Donald Trump of the Federal Reserve Board over the speed of these rate increases, the resulting ongoing strength of the US dollar and the US mid-term elections, and you have the recipe for a sell-off. Whilst none of the causes of the sell-off are particularly new, the growing evidence of the damaging effects on global growth of Donald Trump’s trade policy were perhaps the main triggers. The JP Morgan Global manufacturing PMI index fell for the fifth month in a row in September to hit a two-year low. Emerging market data was particularly weak within the mix, with China showing stagnant growth. Of particular note was weakness in new orders, partly driven by the first decline in global trade volumes since June 2016. This news dragged the Chinese and broader emerging stock markets down further, continuing their sluggish performance in 2018. In Europe, manufacturing data, whilst still in expansionary mode, exhibited a broad-based slowdown, with German, Spanish and Italian growth sliding to the lowest for two years and Italy showing stagnant manufacturing growth. Exports and new orders growth slowed down across the board, with the sluggish demand and growing customer risk aversion being linked to trade wars and leading to a three-year low in business confidence. Whilst German 10-year government bond yields weakened over the month (from 47bps to 39bps), Italian yields rose by 30bps to close at 3.43%. In the last six months, Italian bond yields have risen by 164bps whilst German yields have shrunk by 17bps. The issues in Italy have had an ongoing negative effect on European banks.In the UK, economic data yet again remained resilient, particularly so given the continuing negative sentiment around the Brexit negotiations (and lack of any real progress over the month). The quarterly Deloitte CFO survey assessing the long-term impact of Brexit showed a post referendum high 79% of respondents believing that the outlook would be worse.

Will sentiment on Brexit get much worse than this? Sterling, interestingly, was resilient over the month against both the US dollar (-2%) and the euro (+0.5%). Whilst monthly UK manufacturing (slightly stronger), services (similar) and construction (slightly weaker) data for September were broadly in line with expectations and recent trends, most importantly for us was the ongoing improvement in real wages. CPI inflation fell further in September to 2.4%, down from 2.7% a month earlier, whilst wages rose by a very healthy 3.1% nominal or 0.7% real, continuing the recent trend of improving household finances. Further measures in the budget aiming to end the programme of austerity should help cement these improvements.

Strategy update

The Fund underperformed in returning -6.02% versus a -5.03% return for its benchmark, the FTSE All-Share TR Index (12pm adjusted). This underperformance was in the main driven by size and sector allocation effects. In terms of size effects, there was a distinct bias to returns over the month in the UK, with the FTSE 100 index performing relatively best in falling by 4.9%, whilst the FTSE 250 and FTSE Small Cap indices fell by 6.7% and 6.4% respectively. The Fund is underweight FTSE 100, whilst overweight FTSE 250 and FTSE Small Cap.

On a sector basis, the Fund is underweight the more defensive sectors like utilities, personal goods and healthcare, whilst in telecoms, being overweight Vodafone rather than BT was also a negative. Elsewhere, the Fund is essentially neutral oil & gas, basic materials and financials whilst overweight industrials and consumer services. Within financials, the real-estate sub sector, where this Fund has a growing exposure (c. 6.5% including house builders), performed very resiliently, as did the consumer services sector, suggesting to us that these sectors, which have a high UK component, are finally starting to find some valuation support.

Other than being underweight more traditional defensives, the main area of weakness for the Fund came within the industrials sector. Within this sector, Electrocomponents, still one of the Fund’s largest active positions, gave another very strong trading update at the beginning of the month, driving further earnings upgrades, but it was not enough to fight the ever toughening sector backdrop. Whilst initially rising on the announcement, the shares reversed course aggressively to close the month down 14%, and down 17% from the early month high, as investors chose to sell any stocks deemed to have a high P/E and high expectations. This cost 32bps of relative performance. Although inevitably linked to global and US industrial production, with a high quality management team, balance sheet, strategy and lots of idiosyncratic drivers of returns, we feel there is much more to this story than the global cycle. As the month wore on and the share price sank deeper, we decided to rebuild some of the position on a P/E of c.15x 2019.

We continued to build the Fund’s position in Essentra, a much newer idea and one which we wrote about in more detail last month as we reallocated away from DS Smith. Essentra’s share price, like Electrocomponent’s, suffered from global growth fears and a rapid de-rating. We see Essentra as a true special situation. It has three core businesses, one of which, the components manufacturing and distribution business, has high margins, high current growth and high returns on capital and which in our analysis is worth much of the group’s current market capitalisation. That leaves two other major divisions (healthcare packaging and filters) which are trading at significant discounts to our assessment of fair value and are undergoing highly intensive management turnarounds. The packaging business, in particular, offers high promise, being in a steady, growing industry (healthcare and pharmaceutical secondary packaging) where there are only two international players. Margins in this division are currently negligible but could and should be nearer 10% in the next few years, on a growing base of revenues of c. £350m. With a group profit of c. £90m currently, just turning this division round offers material upside. Essentra is now a top 10 position for this Fund.

The Restaurant Group – why the market wasn’t bowled over by the Wagamama deal

Whilst we have stated that the Fund’s positions in consumer services were relatively resilient over the month, there was one exception, The Restaurant Group (TRG). The shares suffered from the announcement at the end of the month of a proposed deal to buy Wagamama from Duke Street, a private equity firm. The size of the deal (£559m, almost the same size as the starting Restaurant Group market capitalisation), the size of the accompanying rights issue (£315m) and resulting leverage (2.5x net debt:ebitda ‘out the box’), along with the headline valuation (13x L12M ebitda pre-synergies), combined to surprise both existing investors, where there evidently was not unanimous support, and the wider stock market. On announcement, the shares fell c. 15%. Announcing a deal of this size and ambition in the UK leisure space was never going to be easy in current market conditions. There is, as a result, much current debate and concern over the deal, some justified, some a little overstated.

Let’s deal with valuation first. Wagamama is a high growth and high quality brand, with sector-leading customer satisfaction scores and both UK and international credentials. Having 133 sites in the UK as opposed to 340 Nando’s and 260 Frankie & Benny’s, the brand does not seem over-extended; far from it. Current like-for-like sales are benefiting from volume, price, store maturation and, in particular, the growth of online where their particular brand plays very well. These characteristics are expected to continue for a while and so would be unlikely to come cheaply. But the combination of the two businesses also brings synergies, and this has to be considered when thinking about the valuation.

Deep and relatively easy to access synergies look clear to us. £15m cost synergies and £7m revenue synergies were signed off by the auditors on a base of £43m historic ebitda for the core business. The combined total cost base is c. £850m (£22m of which is the acquired company central costs, c.£210m of which is the combined food and beverage costs). £15m synergy out of this is highly conservative. The £7m revenue synergy is based on converting 15 existing TRG sites to Wagamama. We feel that the analysis behind this is again extremely conservative (using a 2-year payback on converted sites) and that in reality the number of conversions might be closer to 30-40 given the relative sizes of the estates. TRG is also one of the leading food and beverage concession operators in UK airports. Bringing Wagamamas into more airports (they currently have three sites) and other transport sites would again drive further meaningful revenue synergy. The sites are in place and airports want a Wagamama. A well-located airport site would do c. 3x an average site (or more). 13x L12M ebitda, as stated, becomes, within one year (and with no synergies), c. 11x given the current Wagamama growth rate. Within three years and with the synergies we expect, the valuation might be more like 6.0x ebitda. To focus only on the static L12M valuation is harsh in the extreme.

Management are levering up to do this deal. 2.5x starting net debt to ebitda and c. 5x lease-adjusted (from c. 4x standalone) is out of our comfort zone. We accept that. However, given the synergies we expect and the combined cash generation and partial dividend utilisation to do the deal, we are prepared to back management. We believe that within 18 months of deal close we will be well below 2x leverage and below 1x within three years. It is worth remembering that we are still due a reasonable amount of cash flow from the core turnaround and opening programme in 2019. This has seen a number of new pubs and concessions sites come into the group over the last six months. Along with current Wagamama trading and a tight focus on cash, we expect management to deliver on short-term deleveraging targets at the very least. We will be holding them to account on this, and it is a condition of our support. Leveraging up to diversify away from Frankie & Benny’s a little quicker is a little unpalatable and risky, but we believe it is most probably the right thing to do.

The CEO of TRG is young and ambitious but also thinks digitally. He, along with a number of his team, came from Paddy Power and bring strong digital marketing skills and thought processes. As the food business moves online these skills are necessary. Adding these capabilities to Wagamama in terms of driving further footfall will be very powerful. But, more importantly, his view of the rapidly evolving delivery market is key to this deal. Scale is and will be increasingly important in both partnering with and standing firm against the delivery companies. A national footprint is key. National brands will be key. Using your kitchens to embrace delivery through innovative onlineonly offers will be powerful and capital-light growth drivers. Whilst online growth at Wagamama is currently very strong, it is coming only via Deliveroo. TRG’s existing brands (and new ones) are available across all major platforms. Once the deal exclusivity comes to an end with Deliveroo, we expect a broadening of distribution and maybe more favourable terms. Online could become a key driver of the success or failure of this deal 3-5 years hence. This has barely been mentioned in the post deal announcement debate.

We could write so much more about this deal. It is interesting on so many levels. We haven’t even discussed international franchises and whether the current model is sustainable or might become more focused and more profitable in time. Or the US-owned business, which currently loses £3-4m annually and is not a stated synergy of the deal at the moment. Or the use of Wagamama as an international concessions bridgehead. Or the ability to leverage the combined lease estate by driving better deals given the stronger brand portfolio. Yes, it is a little expensive at the headline level and, yes, ‘newco’ will be a little more geared. But ‘newco’ is also so much more interesting, faster growing, diversified, sustainable and ultimately cheaper for the deal. We are gobsmacked by the level of negative headlines this deal has created. We will take no further part in the debate. We support the deal.

Alex Savvides, JOHCM UK Dynamic Fund